Precision farming market to grow to USD 15.6 billion by 2030

A growing interest in precision farming technology among farmers and growers creates growth opportunities for the agtech market, according to a new report by MarketsandMarkets.

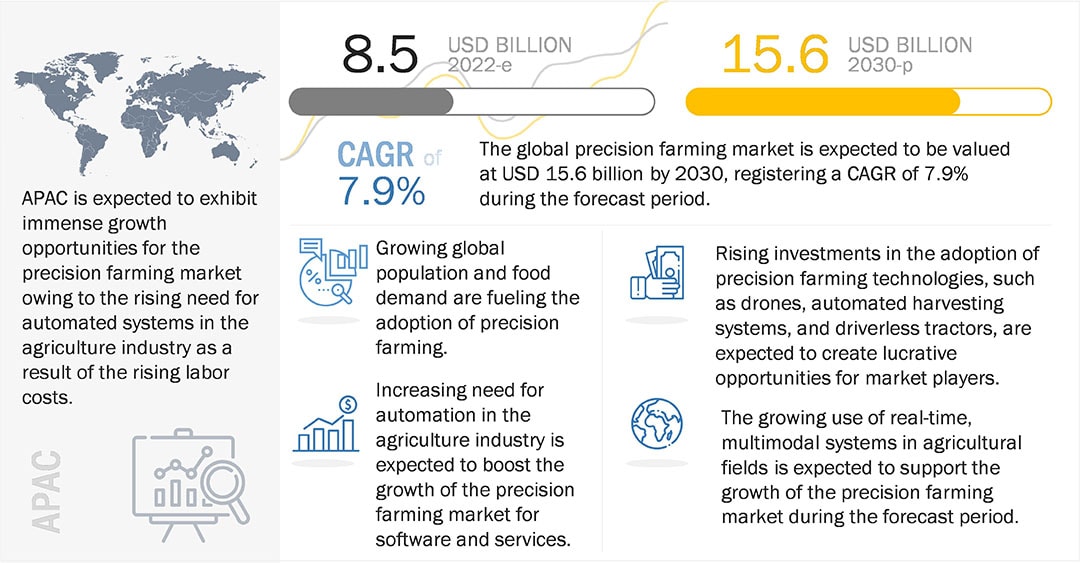

The precision farming market is expected to grow further due to the growing adoption of global positioning system (GPS), guidance, and remote sensing technologies by farmers and growers. The precision farming market is expected to grow from USD 8.5 billion in 2022 to USD 15.6 billion by 2030, at a CAGR of 7.9%, according to the latest report by MarketandMarkets.

Precision farming technologies, such as guidance technology, remote sensing, smart sensors, drones, and variable rate technology (VRT), have enabled farmers/growers to manage soil and increase crop yield effectively. These technologies are used with on-field equipment and devices for guidance and navigation applications. The report states the market’s growth can be attributed to the benefits of climate service initiatives that enable farmers to effectively deal with climate-related disasters, improve food security, and enable real-time decision-making in agriculture production.

Text continues below image

Enhancing efficiency and increasing productivity

The most significant factor driving the growth of the precision farming market is the increasing focus of farmers on enhancing the efficiency of their fields and increasing productivity due to the rising global population and food demand. Precision farming has the potential to transform the agriculture industry by making traditional farming activities more efficient and predictable.

The high demand for agricultural products due to population growth, increased adoption of VRT, remote sensing technology, and guidance technologies by farmers worldwide, and strong support from governments for promoting the use of precision farming techniques are the other key factors fueling the growth of the market. However, the high upfront cost of modern agricultural equipment and limited technical knowledge and skills of farmers are expected to restrain the market growth, according to the author of the report, Rahul Kumar.

Opportunities for technology and solution providers

Over the years, the agriculture equipment market has been dominated by suppliers and OEMs. However, in recent years, the growing use of high-tech solutions in farming, such as data analytics and software, has completely changed the market scenario and provided growth opportunities for non-traditional players. High-tech solution providers offer drones, sensors, control systems, and software that support the application of precision farming technologies. The growing use of these high-tech solutions in precision farming is creating growth opportunities for precision farming technology providers.

Drones

The applications of sensors, imagery, and control systems, as well as the use of data management, Big Data, and AI, will become prevalent in the coming years, thus helping new entrants establish their position in the market. Unmanned aerial vehicles (UAVs) or drones are widely being adopted in agricultural fields. They capture accurate aerial images of up to hundreds of hectares/acres in a single flight, which helps eliminate the high costs required by traditional processes. Agricultural drones are cheaper than surveillance drones and equipped with advanced sensors and imaging capabilities that provide farmers with new ways to increase crop yield and reduce the wastage of resources.

Data and standardisation key challenges

Precision farming generates a large volume of data from variable-rate seeding, yield monitoring, mapping, and soil testing to historical crop rotation. This data is analysed for decision-making, and the success of precision farming relies on it. Thus, the effective storage and management of this data are important. The management of this large amount of data requires high expertise, and many users do not have the expertise to use this data for decision-making for their farms.

Another problem manufacturers face is the lack of access to plant or crop data; as a result, their devices lack standardisation and interoperability metrics. However, many large-scale manufacturers are working on achieving high efficiency, and the exchange of key inputs has increased.

Precision farming devices use various interfaces, technologies, and protocols. The lack of standardisation of these communication interfaces and protocols may result in data misrepresentation. Further, the lack of technological standardisation complicates the integration of systems and hinders the optimum data representation. A majority of equipment manufacturers use their own interface communication protocols, which leads to compatibility issues with other manufacturing brands.

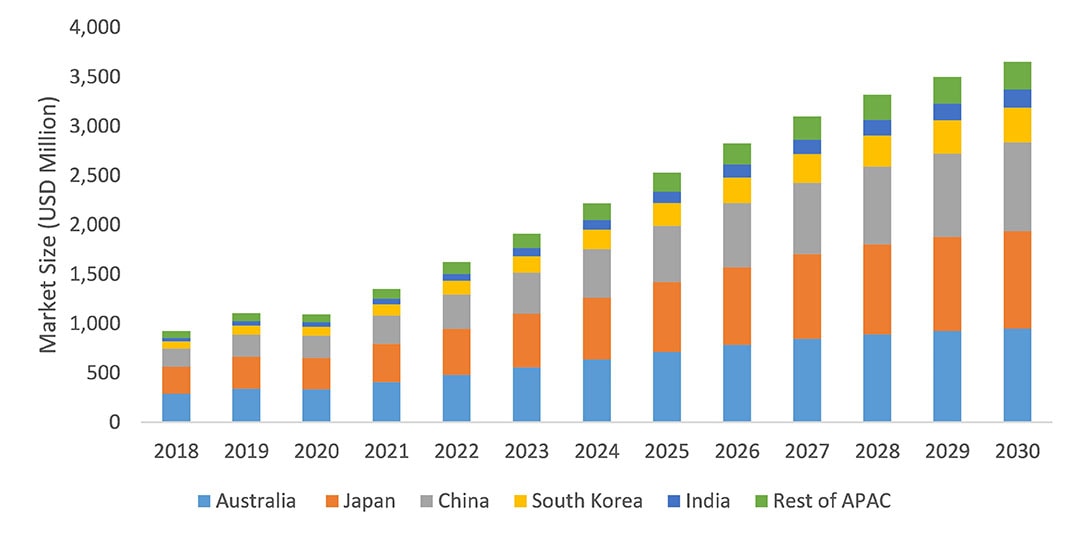

China key contributor to precision farming market in APAC region

The precision farming market in the Asia-Pacific Countries (APAC) is expected to witness the highest growth from 2022 to 2030. The increasing modernisation in the agriculture industry in countries such as China, India, and Indonesia is a key factor driving the growth of the precision farming market in the APAC region. Population expansion in the region’s developing countries is injcreasing pressure on the agriculture industry to increase productivity, thus fueling the demand for precision farming equipment.

Text continues below image

The report states China has pledged to increase investments in its domestic agriculture industry as the country prioritises vital large-scale industries in the near future. Several areas of technology, ranging from AI farming technology to pesticide control, are receiving unprecedented funding. In June 2020, Tianjin Food Group, one of China’s largest food companies, collaborated to develop a smart farming project utilising technologies developed by UK-based companies in China to boost early disease detection and productivity monitoring in pigs. The project, SmartFarm 1.5, will involve Agri-EPI and UK-based companies RoboScientific, Greengage Lighting, and Innovent Technology, working with pork producers for the Tianjin Food Group in northeastern China. In January 2020, Country Garden Holdings Co. Ltd. planned to invest more than USD 2 billion in robotics each year for the next five years to boost automation in the company’s construction, agriculture, restaurant, and property management businesses.

Join 17,000+ subscribers

Subscribe to our newsletter to stay updated about all the need-to-know content in the agricultural sector, two times a week.